- Insights

The DeepTech Goldmine: Opportunities for Investors

The Future of Compute 2025 Report

Deep technology (DeepTech) has been growing in importance and attracting significant investment. Broadly referring to technologies driven by substantial scientific advancements, we at Albion define DeepTech as highly technical, intellectual property (IP)-rich opportunities with durable competitive advantage.

Companies in this space have scientific and engineering breakthroughs at their core, many founded in university labs and spun out to solve the world’s biggest problems.

Compute refers to the raw processing capability needed for complex calculations with enormous capacity, speed, and flexibility to solve problems beyond the scope of conventional machines. It is the backbone of this whole technological evolution and is akin to electricity or the internet, the engine that powers sectors as diverse as finance, healthcare, and manufacturing.

Why is Compute Important?

Given the integral role of compute to nearly every industry, its economic impact is immense. DeepTech has become a strategic pillar for the UK over the last decade and the ecosystem is undergoing a seismic shift. For businesses, access to compute enables better decision-making, faster product development, and reduced research and development (R&D) costs. Researchers use it to accelerate the discovery of new materials, and novel therapies for diseases.

In Albion and Beauhurst’s DeepTech & Future of Compute Report 2025, we examine the investment appetite in compute. The results signal massive shifts in venture capital (VC) dynamics in DeepTech and compute investments, which we summarise below along with how that translates for investors interested in this space.

- The Investment Landscape: Bigger Bets, Larger Returns

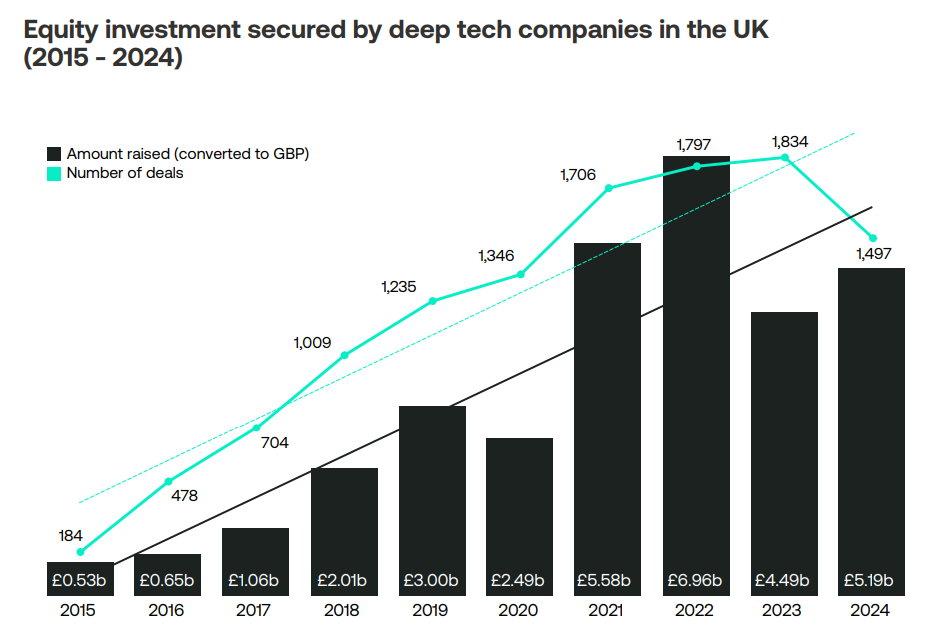

The report reveals that DeepTech companies raised £9.68bn in 2023-2024, reflecting a growing appetite for long-term, high-reward investments. Notably, the size of individual funding rounds has increased, with nearly 40% of compute deals exceeding £10m in 2024.

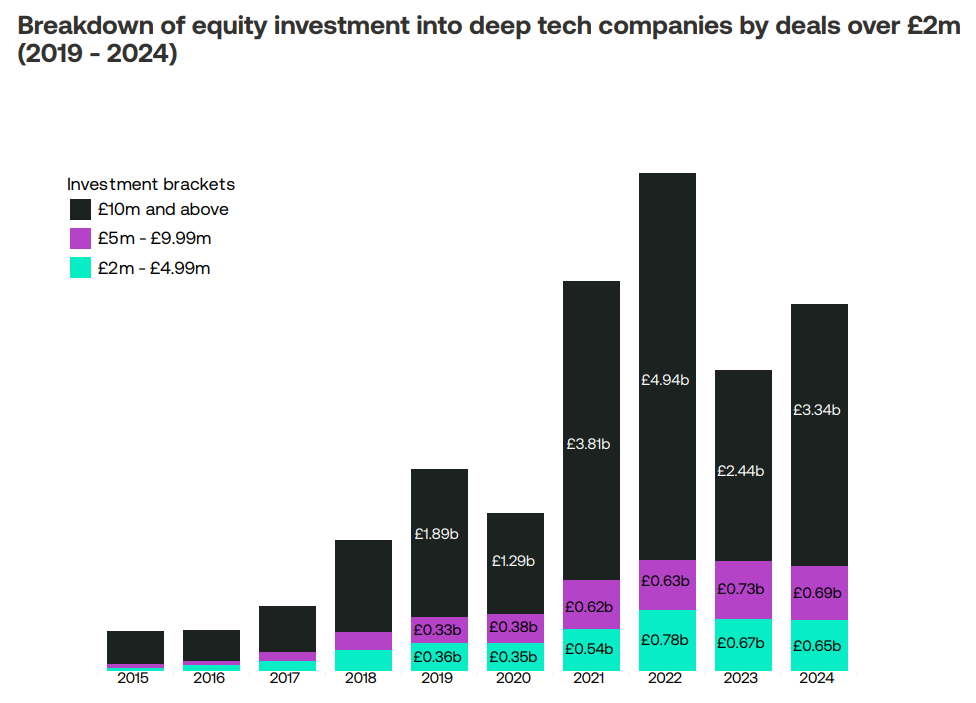

Since 2019, the proportion of investment rounds exceeding £2m has grown significantly, with the total amount invested in such rounds jumping from £2.58b in 2019 to £4.68b in 2024. These larger funding rounds are more valuable for DeepTech companies, which often face long timeframes between R&D and commercialisation.

This signals a shift toward fewer but larger bets instead of scattered seed-stage investments —a clear sign of confidence in DeepTech’s commercial potential. This should excite investors wanting exposure to the space as VCs are concentrating on high-value startups poised for global impact.

2. DeepTech Is Becoming Self-Sustaining

Historically, DeepTech relied heavily on government grants and academic spinouts, but the increase in private sector investment means startups can scale independently. This lowers risk for investors, as DeepTech firms now have more time and resource to build their propositions and stronger commercial viability.

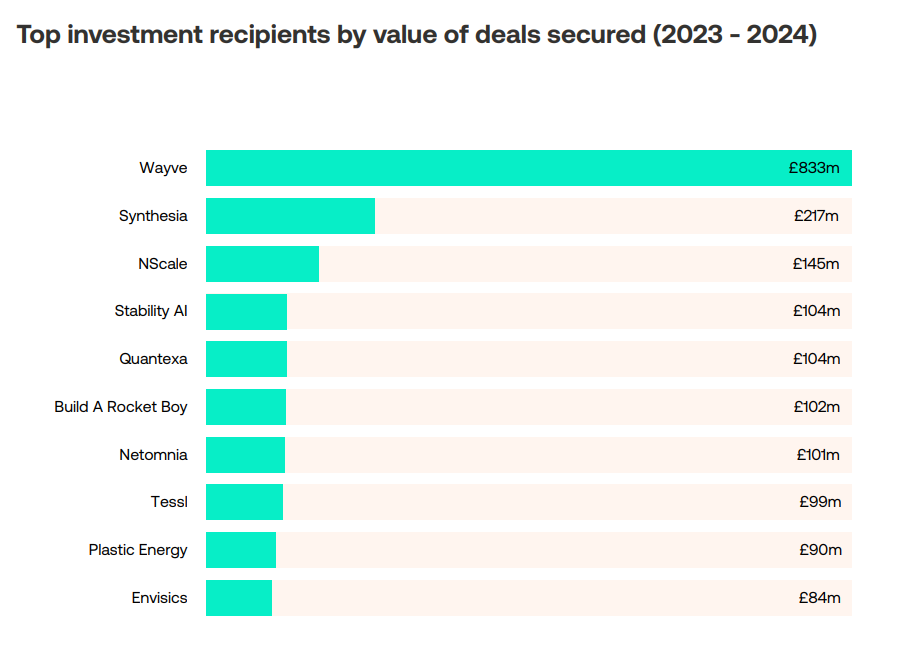

Wayve was the top investment recipient by value, raising a total of £833m via two deals during this period.

The top company raising equity between 2023 and 2024 via a single deal was Quantexa, an Albion portfolio company. The London-based company secured a single round totalling £104m and in early 2025 raised a further £137m.

From an investor’s lens, this suggests that there are unparalleled opportunities to invest in venture capital and gain exposure to high-growth, IP-rich ventures that could define the next era of computing.

Having said that, grant funding plays an important role in nurturing young startups in the space, and while our report shows that grant funding for compute companies has gone up over the past decade, it is still only 10% of the equity investments made in 2024 signalling an opportunity for the government to double down on supporting this strategically important sector.

3. Rising Influence of University Spinouts

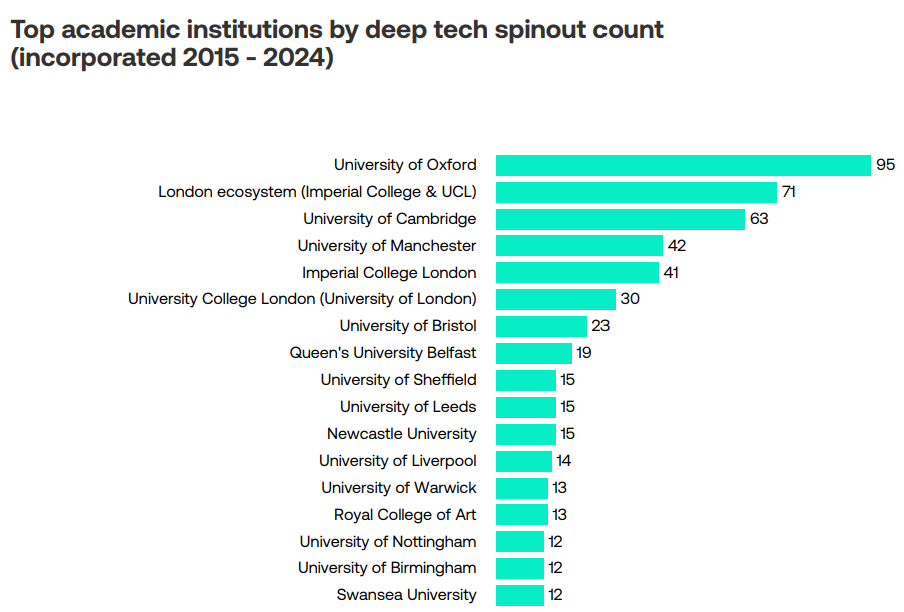

One of the most striking takeaways is the continued dominance of university spinouts with the London ecosystem ranking second by the number of spinouts:

Many of the breakthrough startups securing funding stem from academic research labs, positioning these institutions as prime hunting grounds for early-stage deal flow. London is the UK’s DeepTech hub, home to 42% of all DeepTech companies, with London universities producing a strong pipeline of spinouts.

This means that academic partnerships are a crucial avenue for VC deal flow. VCs like Albion with established relationships with research institutions gain early access to cutting-edge innovations.

4. Potential for Strategic Exits

The influx of funding suggests that deep tech companies are becoming high-value acquisition targets for major tech corporations looking to secure proprietary AI models, quantum frameworks, and advanced processors. For investors, gaining exposure to these companies now via a venture capital investment could pave the way for compelling long-term returns.

Conclusion: The Time is Now

The evolution of compute is redefining industries, scientific research, and everyday technology. As quantum breakthroughs unfold, AI accelerates, and sustainable architectures gain traction, we are entering an era of intelligent, adaptive, and efficient computing.

This report makes one thing clear – DeepTech is a thriving, investable sector that will only grow in importance. The future of compute is unfolding right now, and investors who strategically position themselves could stand to reap the most significant returns.

Access the full report HERE.